3 Advantages of Borrowing an Instant Loan

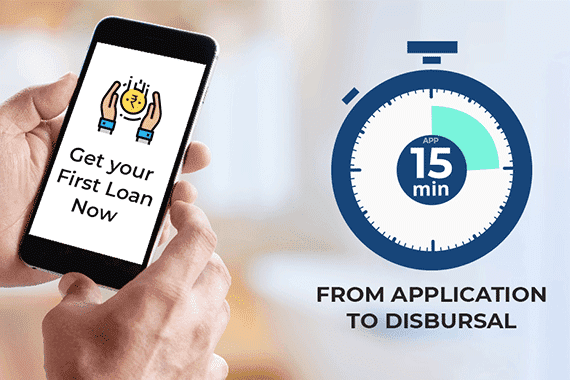

Today, it has become very easy to borrow an instant loan to help meet financial emergencies. There are many loan companies, both online as well as those with brick-and-mortar branches that offer instant loans within a very short span of time (sometimes within just 2-3 hours). In case you have a pressing need for which you require immediate funds, an instant loan may be your best bet. These loans are also offered to people who have a low credit score (because of which they cannot avail a personal loan). To help you decide if an instant loan is a suitable alternative for you, we have listed out its three primary advantages. Read on. 1. Instant access to fast cash This is the main advantage that comes with instant loans. The very meaning of an instant loan is that it is approved instantly, and that you get the funds fast. Sometimes the money is transferred directly into your bank account. All you need to do is fill out an application form, that only asks for your personal detail